Introduction

The national health system (Sistema Sanitario Nazionale, or SSN) is Italy’s flagship, established and protected by the Constitution. Its composition is defined by a system of structures and services that aim to guarantee universal access and equitable provision of health services to all citizens, regardless of gender, sex, age, income or employment.

In order to fulfil its purpose, the National Health System needs to be able to rely on a resilient supply system that is constantly able to respond to the demands of the SSN, particularly at a time when a profound push for innovation is leading to a massive increase in demand for digital products and services.

This digitalisation drive is now considerably funded by the European Union’s Next Generation EU Programme, which translates into our National Resilience Plan. In particular, more than Euro 15 billion have been earmarked for Mission 6 of the PNRR, the one earmarked for “An effective improvement of the National Health System to make structures more modern, digital and inclusive…”.

In this context, Maps Group, with its proprietary solutions related to the world of Digital Healthcare such as, for example, the entire offer line for Patient Experience coverage can make the difference.

Figure 1 Patient Experience areas covered by Maps Group’s proprietary solutions. Source: Standard PowerPoint presentation (mapsgroup.it)

Before going into the details of our offer, it is important, especially for our “non-expert” stakeholders, to understand how the SSN meets its needs for digital products and services and, more generally, how the SSN supply system is regulated and structured.

In this article we focus on the structures and procedures that enable the National Health System to “supply its needs” and talk about one of the first calls for tenders for services related to Digital Health financed with PNRR funds, in which Maps Group also carved out a place as a possible supplier.

The Procurement Rationalisation Programme

In 1999, the Italian government introduced, for the first time, a programme aimed at rationalising and centralising public expenditure (Law No. 488 of 23 December 1999), still in force today, which aims to optimise public procurement of goods and services and to develop procurement models based on innovative processes and technologies.

Through the Programme, therefore, the contact points through which companies offer their goods and services to administrations are regulated and controlled, and the means and tools by which administrations make their purchases are provided.

The image below shows the interactions between the different players in the procurement process of public administrations, including those of the National Health System. It can be seen that the Ministry of Economy and Finance firstly defines the guidelines of the programme and, secondly, regulates through Consip the publication of calls for tenders, monitors and arbitrates the conduct of tenders and competes in the allocation of purchasing initiatives.

Figure 2. The programme for the rationalisation of procurement in the P.A. Source: www.acquistinretepa.it

Consip

Consip is the body in charge of the design and development of initiatives for the procurement of goods and services, operating as a National Central Purchasing Agency. Structured as a joint-stock company and 100% owned by the Ministry of Economy and Finance, it operates, in fact, at the exclusive service of the public administration.

Through Consip, they are provided to PAs and supplier companies:

- The “markets” where products and services can be bought or sold. These markets are the MePA or the Dynamic System.

- The “Tools” for purchasing goods and services. These tools are types of contracts that make it possible to regulate the process and the awarding of supplies.

Given its centrality in the PA procurement rationalisation programme, Consip enables the development of the PNNR itself through the preparation of contracts functional to its implementation.

Focus on the tools made available by Consip

At this point, it is crucial to understand the different types of tools made available by Consip in order to clarify how a company can become a supplier to the SSN and thus win a slice of the funds made available by the PNRR. Like any negotiation, those between the SSN and Companies must be governed by a contract, and special types of contract are the main tools made available by Consip.

Specifically, there are two different types:

- Agreements: tools through which administrations can issue supply orders and successful suppliers, who have become such through a tender process, undertake to accept the conditions of price, duration and subject matter of the supply. Agreements, therefore, have a time limit and stipulate a maximum quantity or amount that the supplier undertakes to guarantee.

Figure 3 How Agreements work. Source: www.acquistinretepa.it

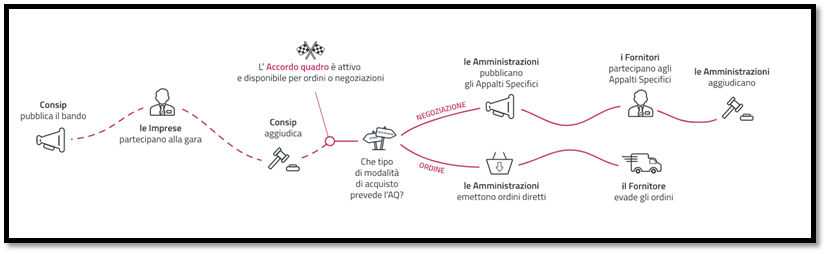

- Framework Agreements: are contracting tools that establish the rules for contracts to be awarded during a maximum period of four years. These tools define the general clauses of the subsequent contracts to be delivered by PAs in a defined time period through direct awarding or specific tenders. Once the Framework Agreement contractors have been determined, public administrations will be able to purchase products and services from them with the advantage of extreme simplification, speed and ease of management of their procurement. Through this tool, in fact, the PAs have “at their disposal” a pool of supplier companies, already controlled and specially selected by Consip, with which they can establish a business relationship either by direct award or by issuing a specific tender.

Figura 4. Come funzionano gli Accordi Quadro. Fonte: www.acquistinretepa.it

Requirements for participation in tenders

In order to be awarded a contract or a place in the pool of possible suppliers of a Framework Agreement, supplier companies must meet certain requirements, some prescribed by law and others specifically required by the tender, the absence/presence of which may result in exclusion/award from the tender.

These requirements are of two different types:

- General requirements: these refer to the professional and moral reliability of the competitors; if not fulfilled, participation in the tender is denied.

- Special order requirements: these refer to the professional capacity and experience required of competitors by the contracting authority. These requirements can be economic and/or technical, and the higher their fulfilment, the better the chances of being awarded the contract.

In this context, companies that do not have the special requirements on their own, or that prefer to increase their chances of being awarded the contract, can form, together with other companies, a Temporary Grouping of Companies (RTI) or a Temporary Association of Companies (ATI).

The RTI, in fact, by cumulating the requirements of the individual companies that form it, participates in the tender by submitting a single joint offer, with the consequent obligation, in the event of being awarded the contract, to jointly perform the services covered by the contract.

Within the RTI, the individual companies are obliged to indicate their shares in the grouping and when awarding there must be a perfect correspondence between the shares in the grouping and the shares in the performance of the services.

Presenting oneself as an RTI is, in fact, practically obligatory in order to participate in tenders for very large Framework Agreements or Agreements such as, for example, those related to the PNRR.

This protects supply, which can rely on a large and diversified pool of suppliers, ensuring greater redistribution of funds allocated by the PA among a multiplicity of players and guaranteeing a certain circularity.

Framework Agreement for the provision of application and support services in the field of “Digital Health – Health Information Systems and Service to the Citizen” for SSN Public Administrations

Consistent with mission 6 of the PNRR, which we discussed in the first part, several calls for tenders were launched by Consip for the award of Framework Agreements or Agreements aimed at the digitalisation of the National Health System. Specifically, one of these is the contracting out of Health Information Systems and Services to the Citizen of the SSN.

In this context, Consul launched a tender for the conclusion of Framework Agreements with a maximum duration of 30 months and a maximum total amount of Euro 540 million.

Due to the high quantity and diversity of the required services, as well as the geographical vastness of the SSN facilities, the tender was divided into 6 different lots, for each of which there is a Framework Agreement of different amounts;

- No. 4 “Application Lots” (Lot 1, 2, 3 and 4) for the awarding of development services, software maintenance services, application management services, addressed to SSN Administrations. Specifically:

- Lot 1: CUP and Health Data Interoperability in Northern Italy, up to a maximum amount of Euro 100 million.

- Lot 2: CUP and Health Data Interoperability in Central and Southern Italy, up to a maximum amount of Euro 150 million.

- Lot 3: for application platforms, portals and APPs in Northern Italy, for a maximum amount of Euro 80 million.

- Lot 4: for application platforms, portals and APPs in Central and Southern Italy, for a maximum amount of Euro 120 million.

- No. 2 “Support Lots” (Lot 5 and 6) for the assignment of Strategic Support Services, Process Digitalisation Services, Technological Innovation Support Services. Specifically:

- Lot 5: for Support Services in Northern Italy, for a maximum amount of Euro 33 million.

- Lot 6: for Support Services in Central and Southern Italy, for a maximum amount of Euro 57 million.

Considering the purpose of this initiative, Maps Group, through its subsidiary Artexe S.p.A., also took part in the tender called by Consip, the participation of which took place in RTI with the agent EXPRIVIA S.p.a. and other companies.

We are therefore proud to announce that Maps Group has been short-listed among the companies awarded Lots 3 and 4 and as such will be able to participate in subsequent specific tenders called by the PAs participating in the Framework Agreement as well as being awarded directly.

This award is a source of pride for us, counting Maps Group among the best Italian companies selected to make a contribution to the digitalisation of our National Health System.